When you examine an investment or business over several years, annual returns can fluctuate—one year may be strong, the next flat, and another a loss. Compound Annual Growth Rate (CAGR) simplifies this volatility into a single, easy-to-compare number.

CAGR answers a straightforward question:

“If my investment had grown at a steady rate each year, what annual rate would take me from the starting value to the ending value over this period?”

Because it accounts for reinvestment and compounding, CAGR is one of the most widely used metrics for evaluating long-term growth in portfolios, stocks, funds, and even company revenues.

What Is CAGR?

CAGR is an annualized growth rate. It assumes:

You start with an initial value (investment, revenue, etc.).

All gains stay invested (or all growth remains in the business).

Growth happens at the same percentage rate each year.

In reality, growth is rarely smooth. Returns might be +30%, –10%, +15%, and so on. CAGR does not show the path you took; it simply tells you the steady rate that would have produced the same final result.

This “smoothing” is both why CAGR is useful and why it can be misleading if you ignore its limitations.

CAGR Formula and Step‑by‑Step Calculation

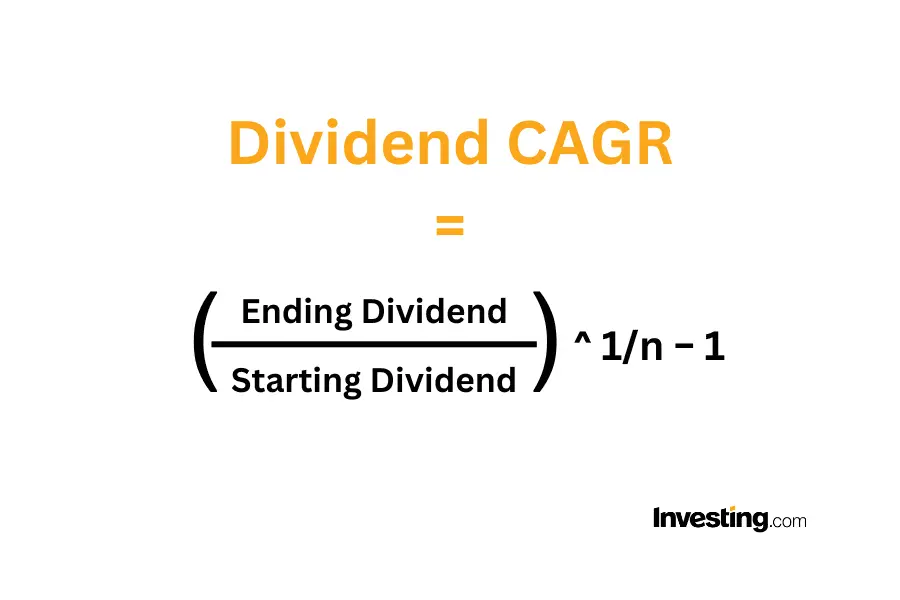

The standard cagr formula is:

CAGR=(Ending ValueBeginning Value)1n−1

CAGR=(

Beginning Value

Ending Value

)

n

1

−1

Where:

Beginning Value = value at the start of the period

Ending Value = value at the end of the period

n = number of years (or other equal‑length periods)

Example: Basic CAGR Calculation

Suppose you invest $5,000. Four years later, the investment is worth $8,000. What is the CAGR?

Divide ending by beginning:

8,000 ÷ 5,000 = 1.6

Take the 1/n power (n = 4 years):

1.6^(1/4) ≈ 1.125

Subtract 1:

1.125 – 1 = 0.125

So the CAGR is 12.5% per year. That means a constant 12.5% annual return, with compounding, would grow $5,000 to $8,000 in four years.

You can calculate this quickly in Excel or Google Sheets using:

text

= (Ending_Balance / Beginning_Balance) ^ (1 / Years) – 1

How Investors and Businesses Use CAGR

1. Comparing Investments

CAGR makes it easy to compare the long‑term performance of:

Two stocks

A fund vs a benchmark index

A stock portfolio vs a fixed‑income product or savings account

For example, imagine:

A savings account grows from $10,000 to $10,500 in 5 years.

A stock fund grows from $10,000 to $14,500 in the same period, but with ups and downs.

Using CAGR, you can convert both results into annualized rates and compare them directly:

Savings account: low but stable CAGR

Stock fund: higher CAGR, but with more risk (which CAGR alone does not show)

2. Evaluating Business Performance

CAGR is also widely used in company and market analysis:

Revenue CAGR (e.g., 12% per year over five years)

Profit CAGR

Customer or user CAGR

Market share CAGR

Because it strips out year‑to‑year noise, CAGR helps you see the broader growth trend and compare one company’s trajectory to competitors or industry averages.

3. Forecasting Future Values

Once you have a reasonable CAGR assumption, you can forecast future values:

Future Value=Present Value×(1+CAGR)n

Future Value=Present Value×(1+CAGR)

n

Example: A portfolio is worth $20,000 today. You expect a 6% CAGR over the next 10 years.

Future value ≈ 20,000 × (1.06)^10 ≈ $35,816

You can also rearrange the cagr equation to solve for:

The required CAGR to reach a target (e.g., how fast you must grow to hit $100,000 in 15 years).

The starting value you need today given a target future value and an assumed CAGR.

This is useful for retirement planning, education funding, and business projections.

Strengths of CAGR

CAGR remains popular because it offers several clear benefits:

Simplicity – One formula, a few inputs, and you get an intuitive annual growth rate.

Comparability – You can compare very different investments or companies over the same time frame.

Noise reduction – CAGR smooths out volatile year‑by‑year data into a clean summary metric.

Versatility – It applies equally to financial investments and operational metrics (sales, users, profits, etc.).

Used as a high‑level summary, CAGR is one of the best tools for quickly understanding long‑term growth.

Limitations and Pitfalls of CAGR

Despite its strengths, relying only on cagr can lead to poor decisions. Here are the main issues to watch:

1. It Ignores Volatility and Risk

CAGR tells you where you ended, not how bumpy the ride was.

Two investments can both show a 10% CAGR over 10 years:

Investment A: steady +9% to +11% every year.

Investment B: wild swings of +40% and –30% from year to year.

The second investment is far riskier, but CAGR alone hides that. To understand risk, you also need:

Year‑by‑year returns

Volatility (standard deviation)

Maximum drawdowns, etc.

Some analysts compute a simple risk‑adjusted CAGR by scaling CAGR down using volatility measures, but that still requires looking beyond the basic formula.

2. It Ignores Cash Flows (Deposits and Withdrawals)

CAGR assumes no money is added or removed during the period. In reality:

Investors often make additional contributions.

They may withdraw cash or partially liquidate.

If you steadily add money to a losing investment, your ending balance might still rise, creating the illusion of good performance when the asset itself actually performed poorly. CAGR cannot distinguish between:

Growth from market performance vs

Growth from extra cash invested

For situations with irregular cash flows, IRR (internal rate of return) or money‑weighted returns are more appropriate.

3. It Is Sensitive to the Time Window

CAGR results depend heavily on the start and end dates you choose. A fund might show:

A stellar 3‑year CAGR coming off a low point.

A modest 10‑year CAGR when you include a previous boom and bust.

Always check multiple time frames (3‑, 5‑, 10‑year) to avoid being misled by cherry‑picked periods.

4. Past CAGR Does Not Guarantee Future Returns

Historical CAGR is a backward‑looking measure. Market conditions, competition, and business fundamentals change. You can use past CAGR as a reference, but not as a promise that the same rate will continue.

Best Practices for Using CAGR

To get the most value from cagr while avoiding common traps:

Use CAGR as a summary, not your only metric.

Always review:

Year‑by‑year returns (or revenue changes)

Volatility and drawdowns

Significant cash inflows/outflows or corporate events

Compare CAGR over multiple time horizons to see how stable the growth story is.

For portfolios with many deposits and withdrawals, prefer IRR or time‑weighted return measures.

In forecasting, treat assumed CAGR as an educated guess, then test scenarios with higher and lower rates.

Conclusion

CAGR is a powerful, easy‑to‑understand metric that condenses long‑term growth into a single annual rate. By learning how to calculate cagr, interpret it correctly, and recognize its limits, you can make better decisions when comparing investments, evaluating business performance, and projecting future outcomes. Use it wisely—alongside other risk and cash‑flow metrics—and it becomes an essential part of any serious financial toolkit.

Are you Interested To Know about Year-Over-Year (YOY)